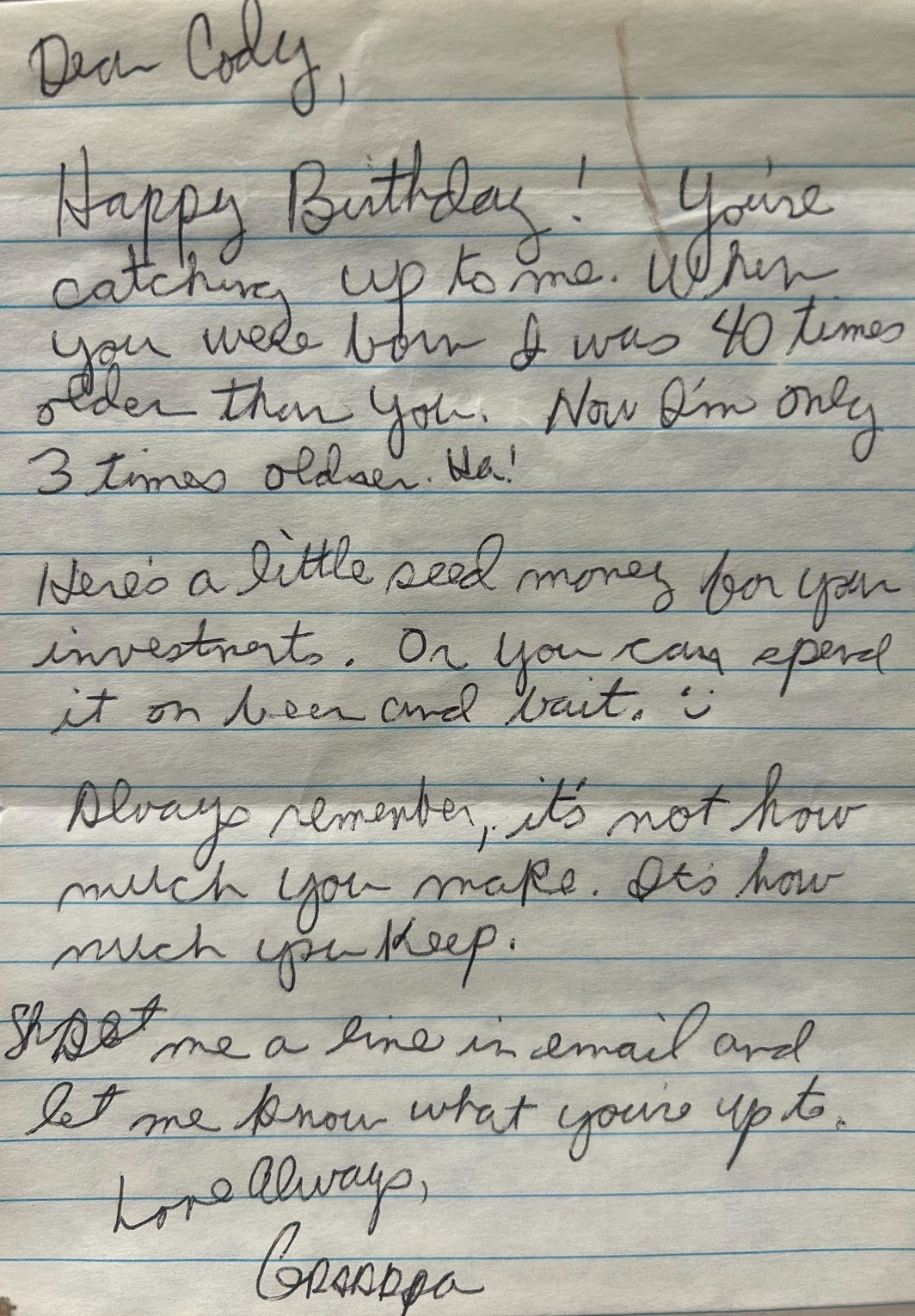

A note from Cody L. Ward, CFP®’s Grandpa:

Dear Cody,

Happy Birthday! You’re catching up to me. When you were born I was 40 times older than you. Now I’m only 3 times older. Ha!

Here’s a little seed money for your investments. Or you can spend it on beer and bait. :)

Always remember, it’s not how much you make. It’s how much you keep.

Shoot me a line in email and let me know what you’re up to.

Love Always,

Grandpa